1. Fundamentals of Bonds

-

What are bonds?

Bonds are debt securities, when you buy a bond, you lend money to the issuer (e.g., government), which pays fixed interest (the coupon) and returns the principal at maturity. The coupon rate remains constant throught the bond period, whereas the price of the bond can change, which changes the effective yield. Let’s explore below the nuances of bond, how macro economics drive the prices of a bond and why gilt funds are falling in India despite rate cut.

2. The Ideal Relationship: Repo Rate ↔ Bond Prices ↔ Bond Yields

-

Repo rate basics:

It’s the rate at which RBI lends to banks. A cut typically lowers general interest rates. ICICI Direct -

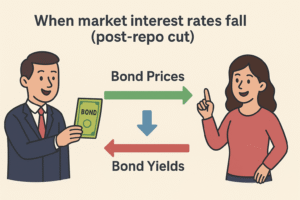

Bond prices and yields:

When market interest rates fall (post-repo cut), existing bonds with higher coupons become more valuable since the newer ones come with lower coupon rate, pushing their prices up and yields down. The exisiting players take advantage of this situation and sell their bonds at higher prices with more coupon rate. Both the buyer and seller has a win-win situation. Buyer gets better Yield compared to what the new bonds are offering and seller gets more yield than the existing coupon rate. The opposite happens when repo rate increases, it makes newer bonds more attractive and existing bonds has to be sold at a discount.

- Transmission channel:

Repo cuts are meant to lower borrowing costs, boost liquidity, and raise bond prices in theory, which lowers bond yields.

3. What’s Actually Happening in India and Why?

Despite the logic above, bond prices (and gilt fund NAVs) are falling, and yields are rising. Here’s why:

a) Shift in RBI’s Policy Stance

RBI moved its stance from “accommodative” to “neutral” after rate cuts, signaling that further cuts are unlikely, which dampened market expectations. mint

b) Supply-Demand Imbalance

-

Reduced appetite from institutional buyers:

Banks (due to HTM restrictions), insurers, pension funds, and NPS schemes have pulled back on gilt purchases. -

Elevated borrowing supply:

Government borrowing remains high while demand has tapered off.

c) Fiscal Concerns Intensify

Tax reforms and fiscal slippages have sparked caution among bond investors, raising concerns about government finances and increasing risk premiums. Reuters

d) Market Sentiment and Technical Pressures

-

A “buyers strike” has pushed yields above critical technical levels. Price corrections follow swiftly when sentiment turns negative.

-

Even announcements of rate cuts failed to rally gilt fund NAVs due to negative sentiment and structural factors. The Economic Times

e) Widened Yield – Repo Spread

Bond yields have climbed even as inflation is subdued, spread between 10-year bond yields and the repo rate has reached nearly 100 basis points, indicating the market is expecting a prolonged pause in easing.

4. Summary of why Gilt funds are falling

| Factor | Impact on Bonds |

|---|---|

| RBI stance shift | Market expects few or no further rate cuts |

| Institutional demand slump | Fewer buyers available |

| Increased supply | Oversupply depresses prices |

| Fiscal concerns | Higher risk premium baked into yields |

| Technical breakdowns | Accelerate sell-off and yield spikes |

| Yield-Repo spread widens | Highlights expectation of policy inaction |

5. Conclusion

While theory suggests that rate cuts should boost bond prices, in India, real-world dynamics, policy signaling, fiscal concerns, supply-demand imbalances, and sentiment are overriding that effect. This results in rising bond yields and falling gilt fund NAVs despite monetary easing. Let’s not rule out the most important economics, price of an entity is determined by demand and supply. Contact